Trading Journey So Far

Blogs

“My Journey in Stock Market, How I began and survive the ups and downs from the Market Uncertainties. “

Shillong :: How I began my journey in stock market, How do I put it? I was completely unaware of stock market nor had stock market ever attracted me before. After few repeated discussions overheard from friends and colleagues about stock market, I had finally decided to try my hand in stock market with an initial investment of mere Rs. 6000, on the fated day 31st December 2021. Caught unaware that I would be stuck with it. But good part of me, is that I never do something with knowing the pros and cons and the details of it. This had finally dragged me to the Fin Fluencers’ world in Youtube flaunting their big wins and lavish lives.

Fin Fluencer’s in my Trading Journey

Initially I was attracted by the wins of these Fin Fluencers, and started learning from them and their videos and follow them religiously. I would not take their names here but very big influential names, and later, most of them turn out to be big losers themselves in F&O or running scams to gain referral brokerage or earn from Fees for joining their exclusive groups/channels in telegram. Lucky for me I decide to learn for free and never did sign up for any paid courses, and slowly but steadily kept on learning.

But yes these learning process from these Fin Fluencers, brought me another interest in my journey, Futures & Options. From here let’s divide my life in stock market into 3(three) phases.

Phase I – Options Buying Phase of My Trading Journey

And I began my journey, with options buying, with no proper in-dept knowledge about the Options. No ideas about the greeks, with little knowledge about of Calls and Puts and their directions and ATM, ITM, etc., I dived into the complex Options Intraday Trading. And as they say, beginners luck, I begun with winning streaks, in fact an extended winning streaks so to say- making my account grow almost 5x Times my investments and having a good amount of fund, I managed to accumulate a good sum of money during this phase. And luck would have it, or, because I had been always thrifty with financials, I managed my risk well without knowing the concepts behind risk managements in options trading. I had never risked more than a fixed amount every day.

Back Then I use feel that I had learned to Trade that’s why, I was winning. But then if I look back now, it was merely a beginners’ luck I won those bets. And due to my thriftiness, I always cut my loss early and the wins I played with it, by trailing. I added more trades only on the winning trades, and the best part of it was that I always protected the previous day wins/profits. At the end in this phase I made pretty good sum (5x) from my initial fund.

Early Morning Scalping Phase in my Trading Journey

During this phase, I mostly traded NIFTY index options that too scalping between 9:15am to 10:00am, and this was going great as I was doing mostly work from home and late arrival to office was discounted due to the recent Covid factors ongoing during this phase. And well, a stroke of luck again, a day before Russia Ukraine War, I had some overnight Put long positions, and in fact it was the first ever overnight position, due to Gamma Move- (A concept I was unaware before), and being in the right direction, and market opening a gap down, profits bloated almost as high as 200x. And since then I never did risk too high to let go of this profit, even today.

Key Take Aways from these Phase-

- My Trades had been lucky

- I Focused on Learning side by side

- I controlled my risk

- I protected my profits/gains

Phase II – Short Strangle Phase of My Trading Journey

Post Russia Ukraine War, and as market stabilized, it gave a reality check, and I was going on back to back losses, my nature of being thrifty, protected me and funds I accumulated, once again. And after few back to back losses I went back to learning board, started learning in depth about the greeks and their behavior and how they affect the prices of options strikes. And This let me to Option Selling.

RESTART myself again, and started with OTM option Selling, mostly OTM strangles for weekly expiry of NIFTY 50, which again gave me some confidence into winning ways back again. I was back to winning mostly but very small in amounts. My win rate had improved from 52% to 82% but the winning amount had reduced drastically.

This move to shift to option selling, (Note:- already a good amount of fund had been accumulated with beginners luck by this time.) had let to a newer concept called pledging- as I never stopped learning, I kept continuing learning. So I started pumping the fund into stocks. And before investing in stocks, I had dedicated some time to understanding and learning them, I followed these steps meticulously:-

Stock Selections:-

- Bought only NIFTY 50 stocks and Large Caps – They are too big to loss.

- Promotors Share Holding is High – Promotors will never let their company loss.

- Rising FII, Mutual Fund Holding or At least they maintained same holding.

- Valuations is Good.

- Promoters Shares pledging is low or NIL.

- Diversified across sectors

- Index ETFs, Gold ETFs, Mutual Funds Etc.

By meticulously following the rules I bought shares at regular interval whenever the requisite stocks/ETFs fell at least 1%. Over the time my investment had grown and healthy percentage of growth more than FDs & RDs and the same had been pledged to use as margin for option selling, and only a little amount of fund was kept in liquid to mitigate for any losses in the Intraday.

What Rich Dad, Poor Dad Taught me.

Pledging had given me 2(two) benefits – a) Margin b) Shares will continue to grow along with the margin (I learned this while reading book called Rich Dad, Poor Dad – By Robert Kiyosaki using debts to buy assets not liabilities).

In this Phase, I didn’t earn much despite my improved win rate but my portfolio grew rapidly. Then suddenly market Vix had dropped very low to the range of 9-10, and this was the period I again started loosing big on days, there by negating the profits of the winning days in a week.

Mostly I would trade 5 days, win 4 days ( win amount is small) and loose 1 day( loose big and wipe all the wins of the week) these way I was week on week I was mostly flat to negative. But as always I continued playing safe, I traded mostly 2(two) lots – 1 Call and 1 Put, therefore, even though I was net on net loss during this phase but if I include Phase I(one) I was still in profits by a good margin.

Key Take Aways from these Phase-

- Investing in Value stocks, and earning through compounding

- Reality check that I am still a novice in trading

- Investing in assets classes with debts for good return

- Value Investing

- Never Stop Learning

- Humble yourself before market, as market is ever evolving and changing- adapt with it.

Phase III – Break Even or Directional Selling Phase of My Trading Journey

Good part of me, had always been recording and diarizing my journey, continue to stress and urge to learn. After few months of flat to little draw down in the account value curve, I had decided to read books to continue with my learning, Books focusing on Price Actions, Psychology and Risk Managements, along with Fin Fluencers’ youtube videos. Started following some genuine traders in Twitter(X) and followed their threads– Learned from their mistakes.

Books that I had piled up and read during this phase–

- How to Avoid Loss and Earn Consistently in the Stock Market

- How To Make Money With Breakout Trading 2.0

- Price Action Trading : Technical Analysis Simplified!

- Trading Chart Pattern book,

- TRADE LIKE A STOCK MARKET WIZARD BY MARK MINERVINI

- How I Made $2,000,000 in the Stock Market

Disclaimer: Reading these books will not make you an expert in trading but definitely help you in understanding the pros and cons of the market.

After reading many books and learned some valuable lessons, I changed my tactics from non-directional weekly strangles to directional intraday selling. And set some strict rules and system to trade. For the past few months I am stuck to these Rules and System.

My Trading Rules and System

- Trade only Intraday

- Strictly trade on the instrument that is expiring or 1 day to Expiry.

- Only 2 trades per day profit or loss.

- Qty of lot per day is fixed for 3 months.

- Profit Booking, at 65%-70% of the target(observing the Price Action), Stop Loss at 35%-45%(observing the Price Action)

- Once the trade is green avoid going to back red at all cost.

- Stop loss at system keep it very far, to avoid hitting, this is kept simply to keep the Sudden Gamma move/Freak trade such as sudden 2% rise or fall in checked.

- For actual stop loss, keep alerts at levels as decided. Exited when alerts hits.

- Keep alerts at target levels as well as.

- Once Trade Exited clear all the Stop Loss orders punched.

- Analyze charts and data at 8:00am before trading hour begins.

- Plan the entry and exit levels before hand.

- Entry only after 10:00Am, knowing the probable direction of the market.

- Exit or try to exit before 2:30Pm as Gamma move may kick in after 3Pm for expiry instruments.

- Start with directional trades.

- Convert to strangle if some good probability is observed- based on Price Action.

- Positional Only if there is some strong reasons behind it and strictly hedged trades.

Changed in my Trading Journey

I have changed myself from discretionary to system/rule based trader, and growing as I continue to learn. And I am learning from what ever sources available with me. And during this period, I look back how lucky I was winning those trades back then. And I am still a novice and learning each day.

Learned to restrain myself from the emotions and urge to over trade, only 2 lots per trade per day. And this helped me to maintain or protect the gains of my lucky trades so far, and for past 2(two) quarters its been a humbling experience that I had been growing my account both equity as well as F&O slowly but steadily.

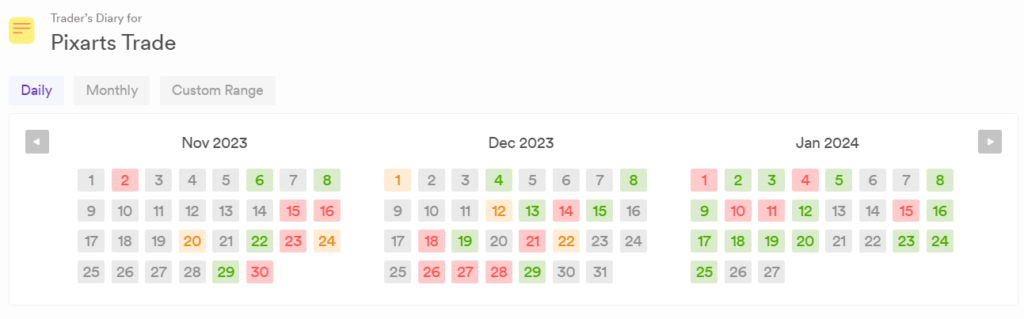

At the end of this phase here I am sharing my trade diary:

But even today I can’t confidently say that I have cracked the market code, market may anytime change and evolve, and again will be back to losing ways, and I will need to go back to the drawing board, RE-START AGAIN. Market is ever evolving – to survive we need to keep learning and keep evolving. But what will stay with me are the knowledge, rules/systems and the discipline I have inculcated over the time.

Key Take Aways From this phase–

- Market is evolving

- Stick to the System

- Avoid Over Trading

- Avoid FOMO

- Continue Learning

- Discipline

- Don’t Revenge Trade