Psychology and Trading

Blogs

Trading psychology refers to the mental and emotional factors that influence traders’ decision-making processes. It encompasses a wide range…[..]

Successful trading requires more than just knowledge of financial markets and technical analysis. It demands a strong trading psychology and the right mindset. The field of behavioral finance has shown that human emotions and cognitive biases play a significant role in investment decisions. This article explores the importance of trading psychology, its impact on trading performance, and strategies for developing a winning mindset.

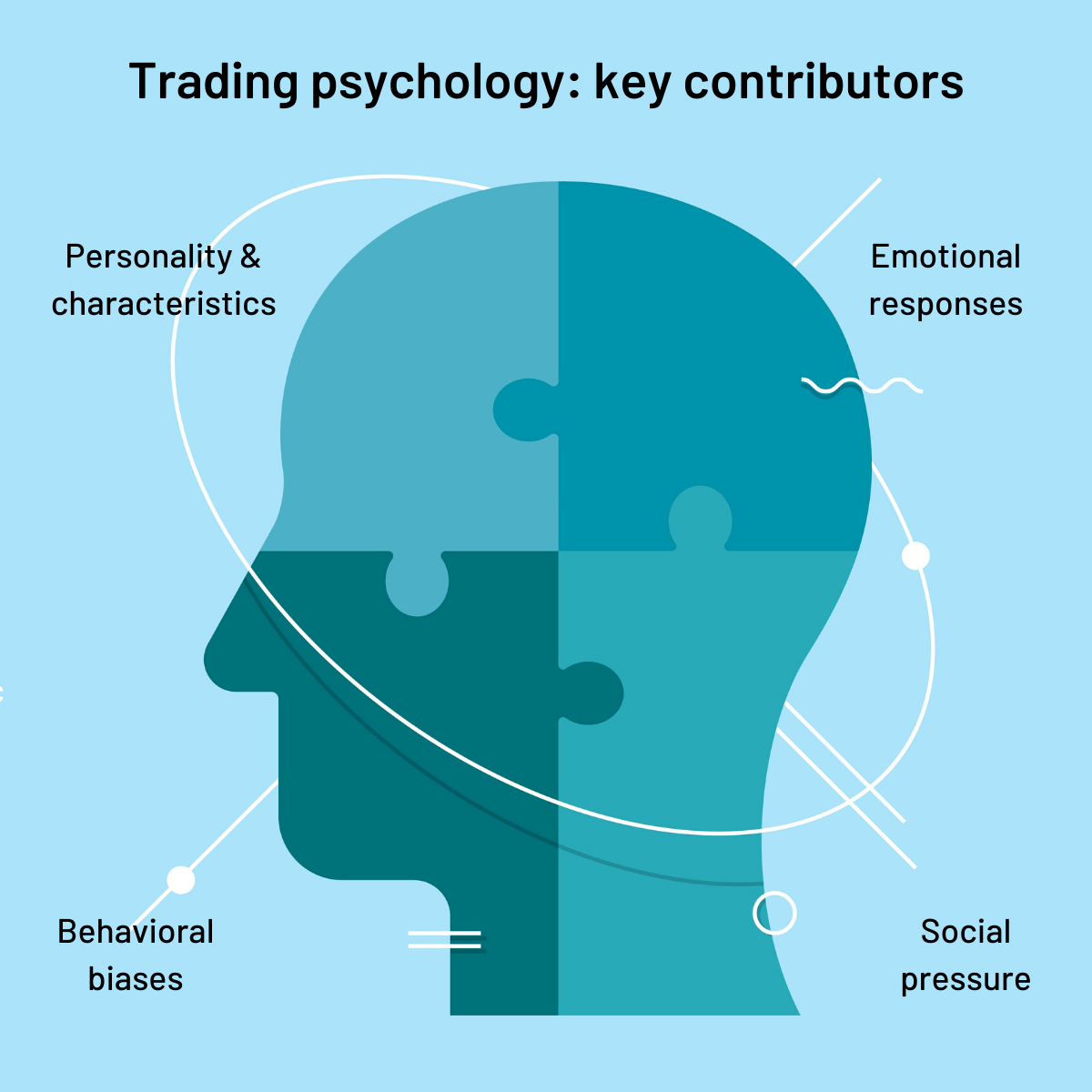

Trading psychology refers to the mental and emotional factors that influence traders’ decision-making processes. It encompasses a wide range of psychological aspects, including emotions, cognitive biases, discipline, and self-control. Traders who understand and effectively manage their psychology are more likely to make rational decisions and avoid costly mistakes.

Emotions can be a trader’s best friend or worst enemy. Fear and greed are two primary emotions that can cloud judgment and lead to poor decision-making. Fear can cause traders to panic-sell during market downturns, while greed can drive them to chase unsustainable gains, leading to impulsive and irrational trades.

Cognitive biases, such as confirmation bias (favoring information that confirms preconceived notions) and anchoring bias (relying too heavily on initial information), can also distort traders’ perceptions and judgments. Recognizing these biases and actively working to mitigate their effects is crucial for objective decision-making.

Developing a Winning Mindset

- Self-awareness: Traders must develop self-awareness by understanding their strengths, weaknesses, and emotional triggers. Regular self-reflection and journaling can help identify patterns and behaviors that hinder trading performance.

- Emotional control: Emotions can be managed through techniques like deep breathing, meditation, and visualization. It’s important to take breaks when feeling overwhelmed and avoid making impulsive decisions during heightened emotional states.

- Risk management: Implementing effective risk management strategies is vital for maintaining emotional stability. This includes setting stop-loss orders, diversifying portfolios, and avoiding excessive risk-taking.

- Discipline and patience: Successful traders adhere to a well-defined trading plan and exercise patience. They understand that the market can be unpredictable, and not every trade will be profitable. Sticking to a plan helps eliminate impulsive actions driven by emotions.

- Continuous learning: Developing a growth mindset is crucial for traders. Embrace failures as learning opportunities and continually seek knowledge and improvement. Stay updated with market trends, read books, attend seminars, and engage with other traders to expand your understanding.

- Positive self-talk: Cultivating a positive mindset and adopting constructive self-talk can significantly impact trading performance. Replace negative thoughts with affirmations and focus on the process rather than obsessing over outcomes.

Mastering trading psychology is essential for achieving long-term success in the financial markets. By understanding the role of emotions, biases, and psychological factors, traders can develop strategies to manage their mindset effectively. Cultivating self-awareness, emotional control, discipline, and continuous learning are key elements of a winning trading psychology. By adopting these practices, traders can enhance their decision-making, mitigate the impact of cognitive biases, and maintain a balanced approach to trading, ultimately improving their chances of achieving consistent profitability.