Expiry Special – 8th June 2023

#safebull , Analysis , Educational , Information , Learning

Tomorrow’s expiry will be a very interesting one, with the RBI MPC’s decision’s announcement at 10:00am, the market is anxiously lingering around the top in a clueless direction. RBI MPC’s decision tomorrow will give a clear direction to the market. Looking at the importance of the event, analysis on how the market could react is hereby shared…[ Read More ]…

Expectations, Support & Resistances

WARNING !!!:-

- This just a personal opinion & view.

- This is not a trade advice.

- We are not SEBI registered.

- This is just for educational purpose only.

- Please consult your adviser or do your own analysis before taking any trade.

- By no means we shall be responsible for any of your losses or profits, in case trades executed by using these information’s.

- Read the full Disclaimer.

8th June 2023 – Expiry

Tomorrow’s expiry will be a very interesting one, with the RBI MPC’s decision’s announcement at 10:00am, the market is anxiously lingering around the top in a clueless direction. RBI MPC’s decision tomorrow will give a clear direction to the market. Looking at the importance of the event, analysis on how the market could react is hereby shared.

- 08 Jun 10:00 AM RBI Interest Rate Decision India *** expected 6.75%

:: Technical Analysis

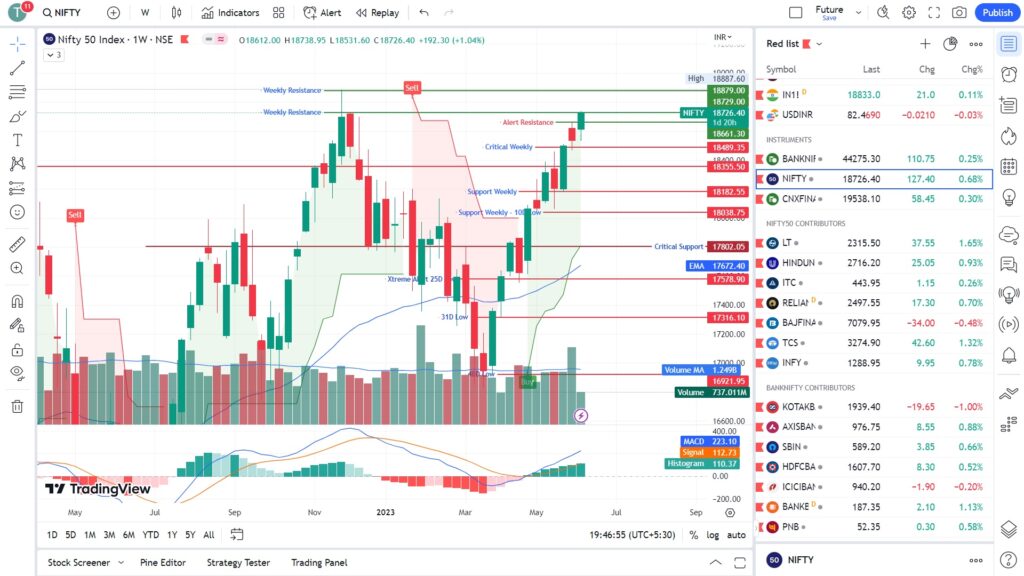

Weekly Chart – Weekly chart looks very bullish, today market closed just above the level where it previously fell from all time high, with a favorable nudge by RBI MPC could trigger a new all time which is very much on the reach, or could tumble down- if unfavorable. If we look broadly we could see a cup & handle pattern, indicating a week in negative domain in the upcoming weeks. Refer the Fig. 2

Daily Chart – Price action on the daily chart is very bullish, after the recent correction in last few sessions, the market remained range bound on Monday and Tuesday session. Finally market has given a break out today, and a new higher high is formed, and with RBI MPC outcome tomorrow, a big move is anticipated, more in the positive side with strong technical support at 18600 – 18650 level. Refer the Fig. 3

Today, on the first 3 hours the market traded range bound lingering above the previous high and towards the second half given a strong break out. Pattern looks very bullish, however if the market opens gap up, it is best to wait for the market to dip then enter. But if the market opens flat or gap down near 18650 level, we can enter long. It is not a shorting market, avoid shorts at all cost.

Important Levels:

Resistance – 18750 – 18800

Support – 18650 -18700

No trading Zone- 18750 -18800

Previous Day – Positive

Previous Week – Negative

NOTEWORTHY:-

Price action on the daily chart is very bullish, after the recent correction in last few sessions, the market remained range bound on Monday and Tuesday session. Finally market has given a break out today, and a new higher high is formed, and with RBI MPC outcome tomorrow, a big move is anticipated, more in the positive side with strong technical support at 18600 – 18650 level.

Today, on the first 3 hours the market traded range bound lingering above the previous high and towards the second half given a strong break out. Pattern looks very bullish, however if the market opens gap up, it is best to wait for the market to dip then enter. But if the market opens flat or gap down near 18650 level, we can enter long. It is not a shorting market, avoid shorts at all cost.

:: Data Analysis

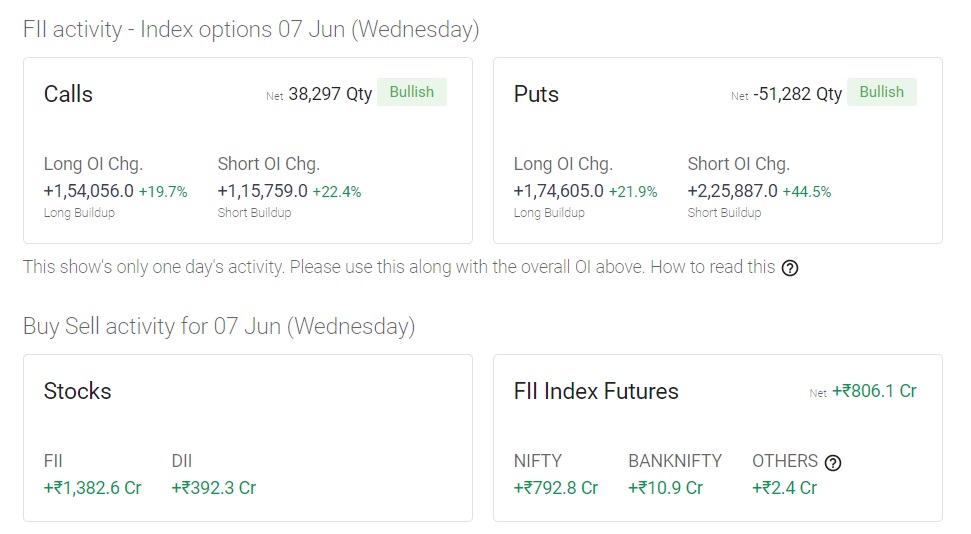

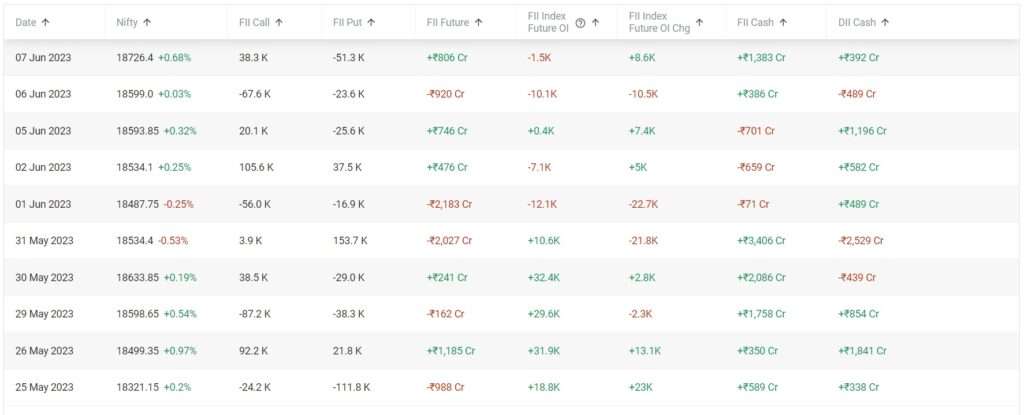

FII & DII Activity-

FII buying observed in all segments.

FII Cash :: ▲+₹1,382.6 Cr

FII Futures :: ▲ +₹806.1 Cr

DII Cash :: ▲ +₹392.3 Cr

Open Interest (OI)-

Lots of fresh put writing at 18650 & 18700 level, unwinding or covering of calls observed.

PCR – 1.1 (+) Very Bullish.

:: Market Sentiments

World Markets – World market is trading flat and weak.

SGX N50 – Closed around 18800 at 8:34pm 07-06-2022

:: FINAL VERDICT

Everything looks bullish, if only RBI MPC decision is positive, market likely to continue its bull run.

Quick links::

- #safebull (14)

- Analysis (6)

- Calendar (1)

- Educational (9)

- Information (10)

- Learning (27)

- Market (3)

- News (6)

- Strategy (17)

- Taxes (1)

The above analysis is solely the opinion of the author, no way an assured tips/direction to trade, they are solely for educational purposes. Please do not trade with out a proper study and analysis, we will not be responsible for your loss. We are not SEBI registered.

#SafeBull