Data for 28th December, 2023 Expiry

Charts , Data

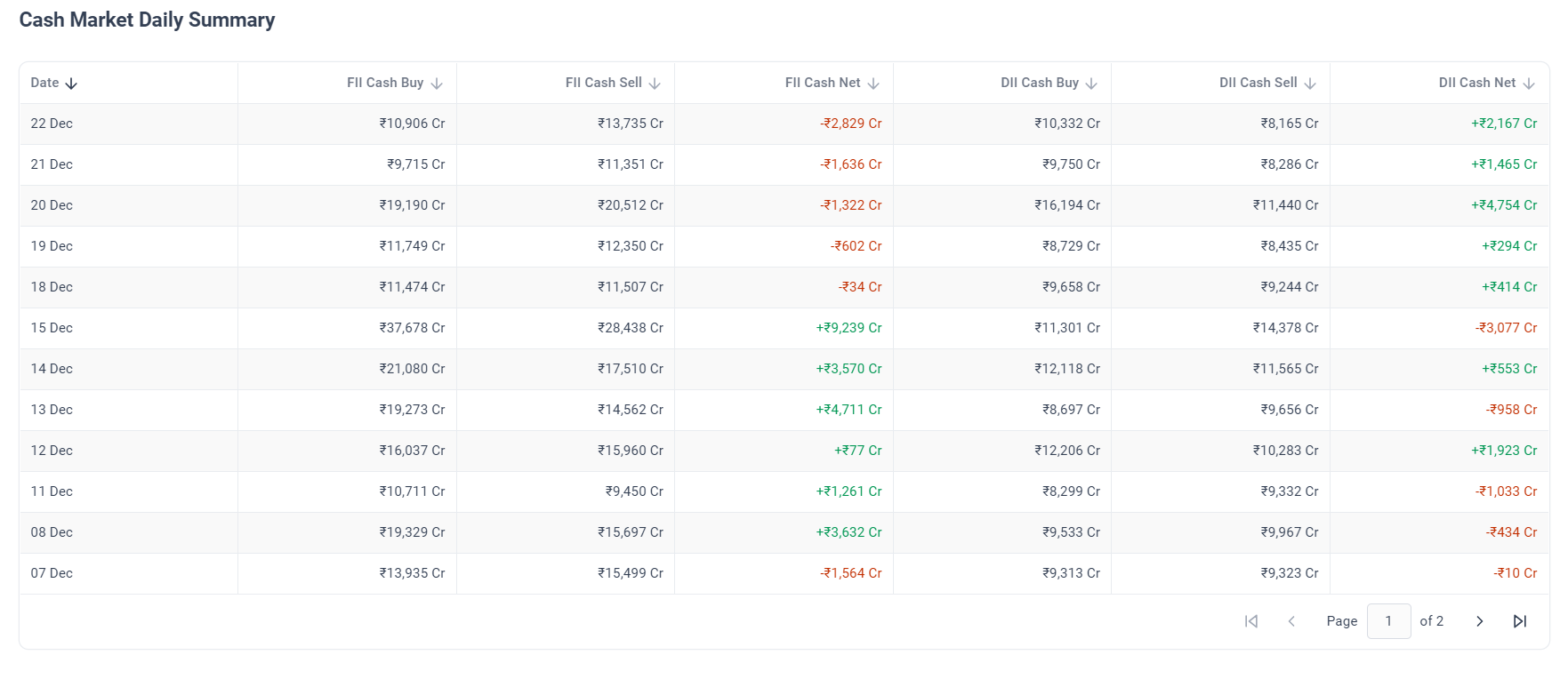

FII & DII Data

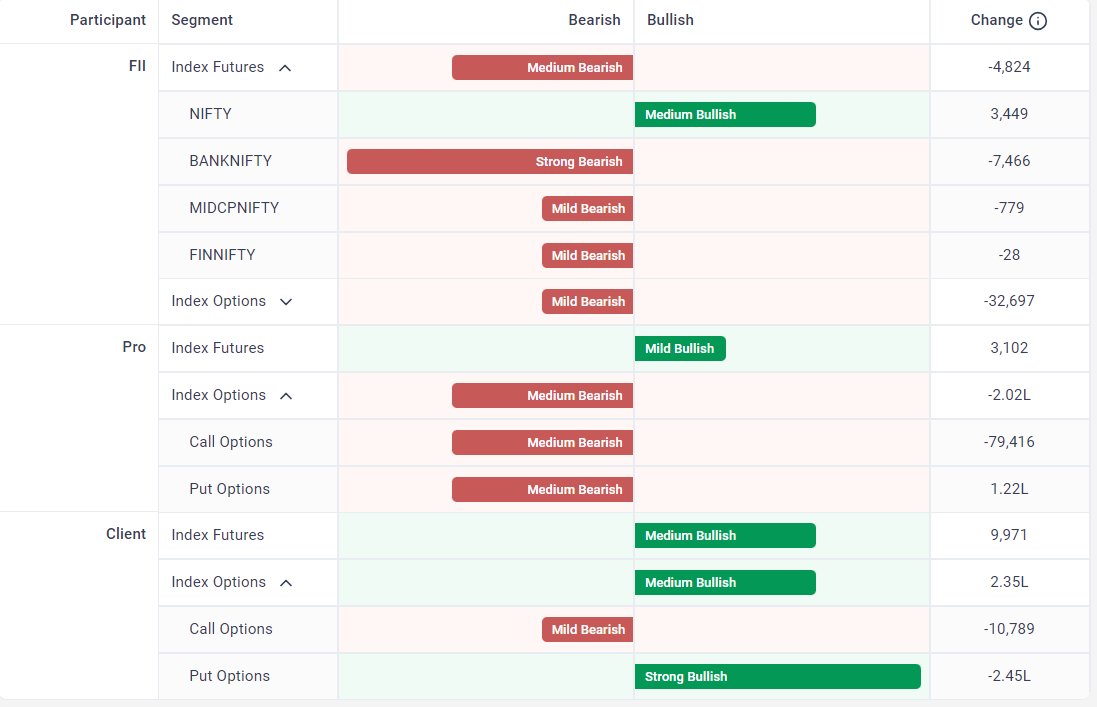

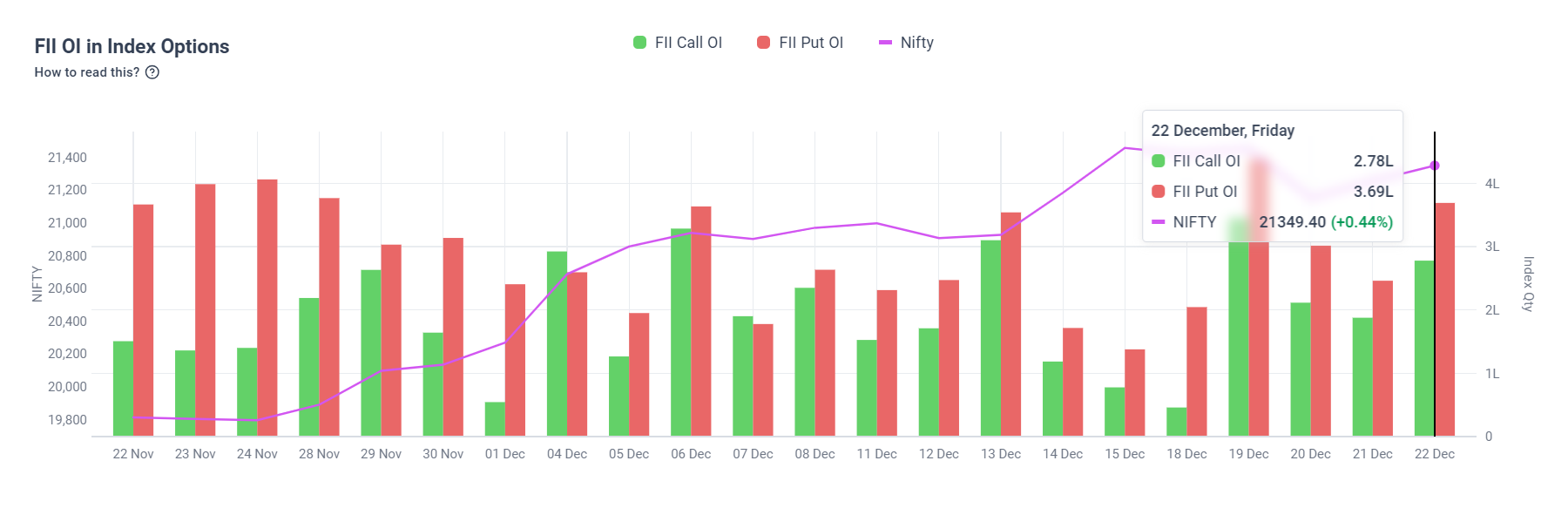

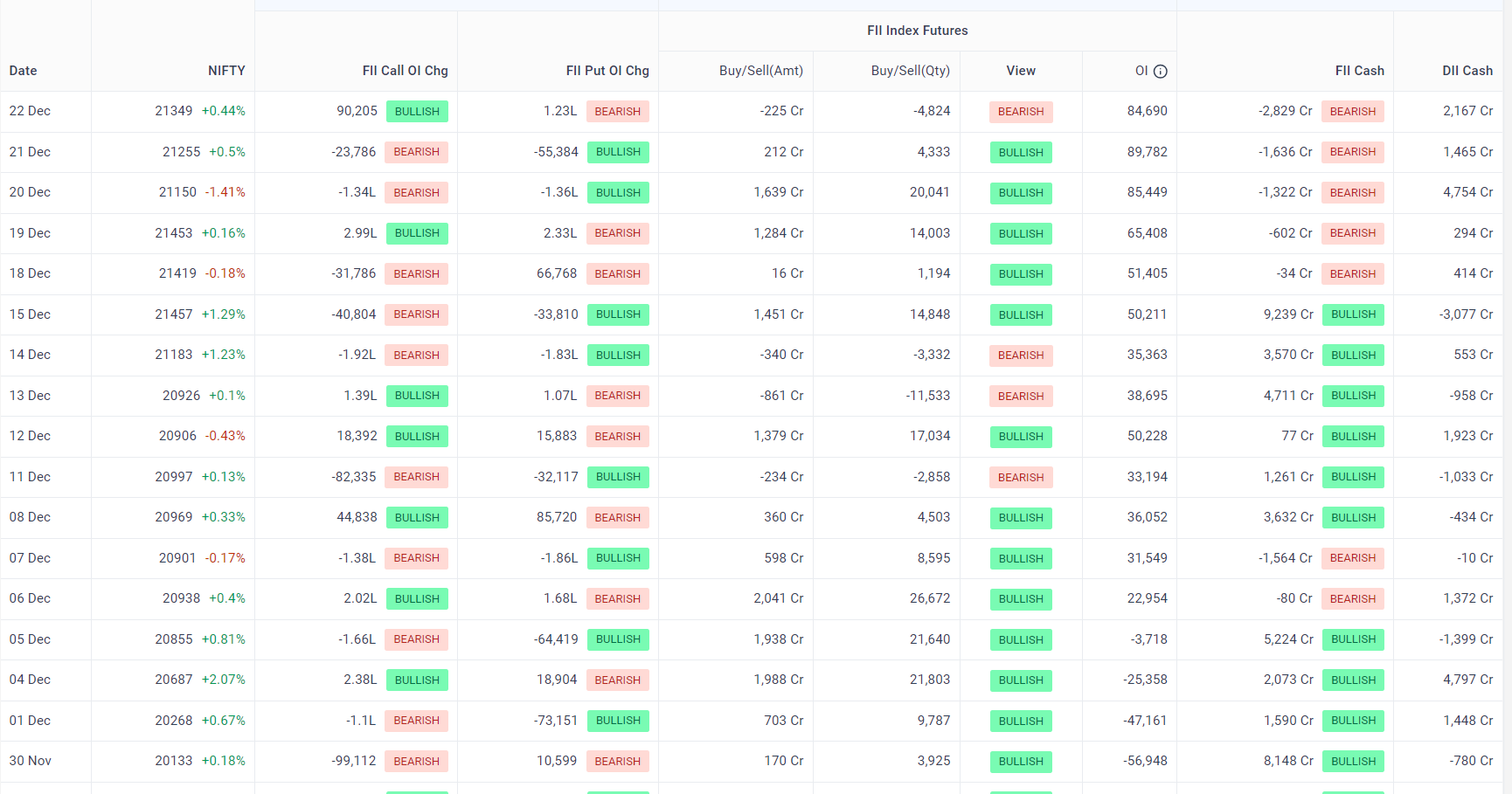

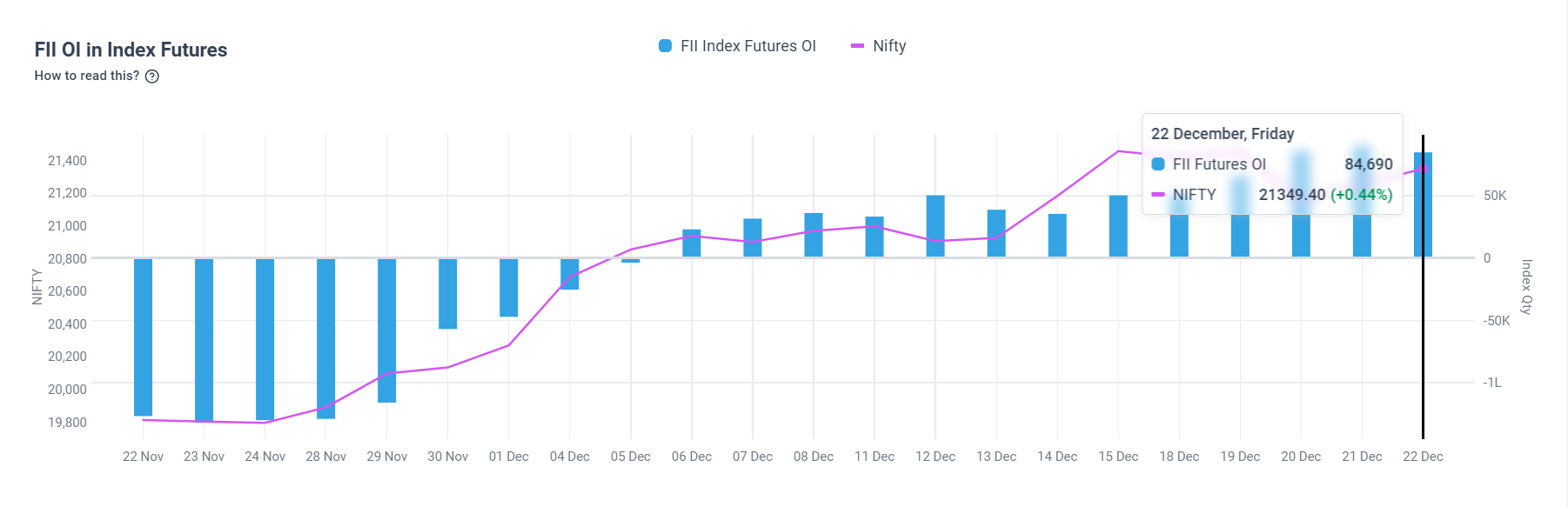

Observations:

FII & DII data suggest market to remain volatile, selling from the top.

- Outstanding puts is 3.69L against 2.7L calls – Heavier on the bear side.

- Last session FII futures activity – Mixed.

- FII stocks is -2.83K Cr – Does not hold relevance for intraday but swing wise negative.

- Net Future OI change = have risen to +84.7K , Looks positive.

Open Interests

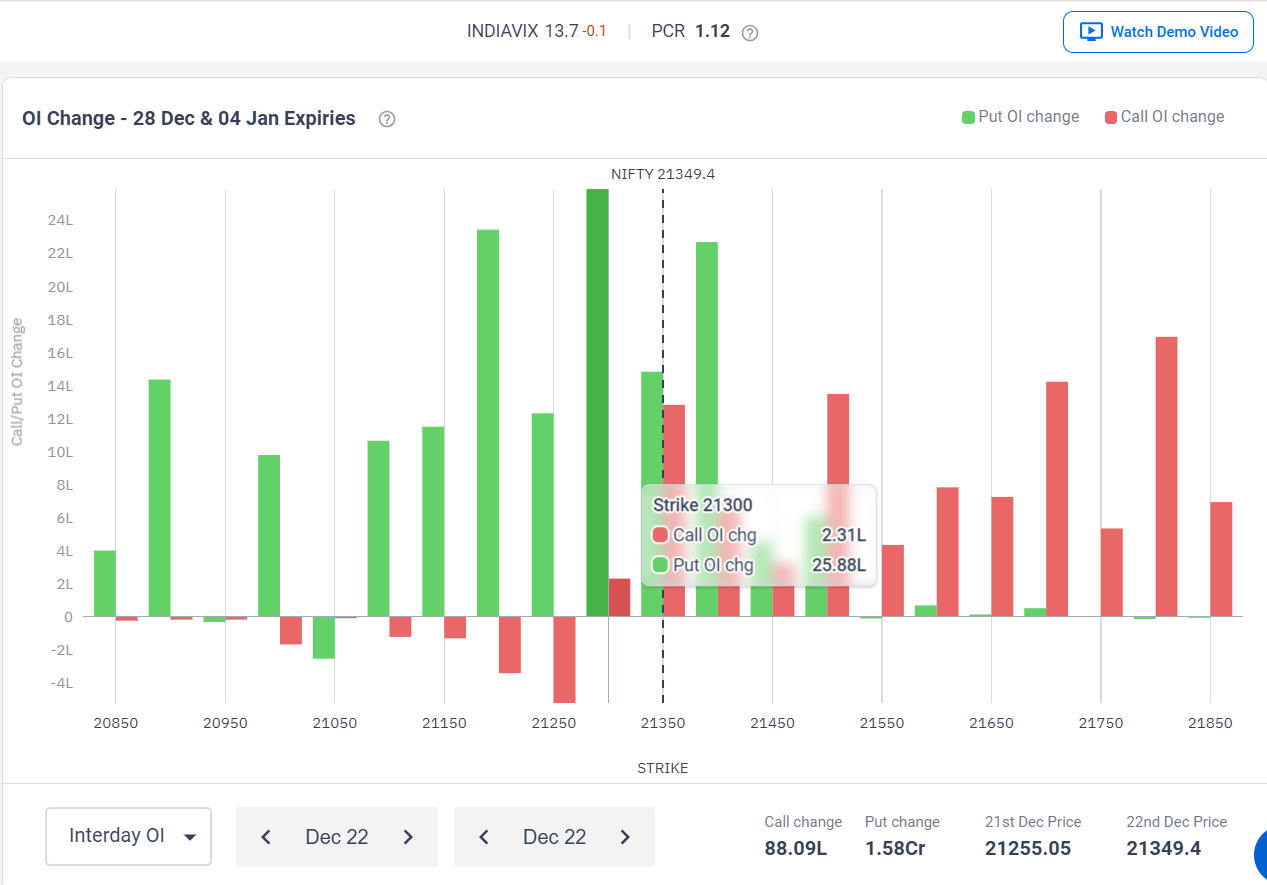

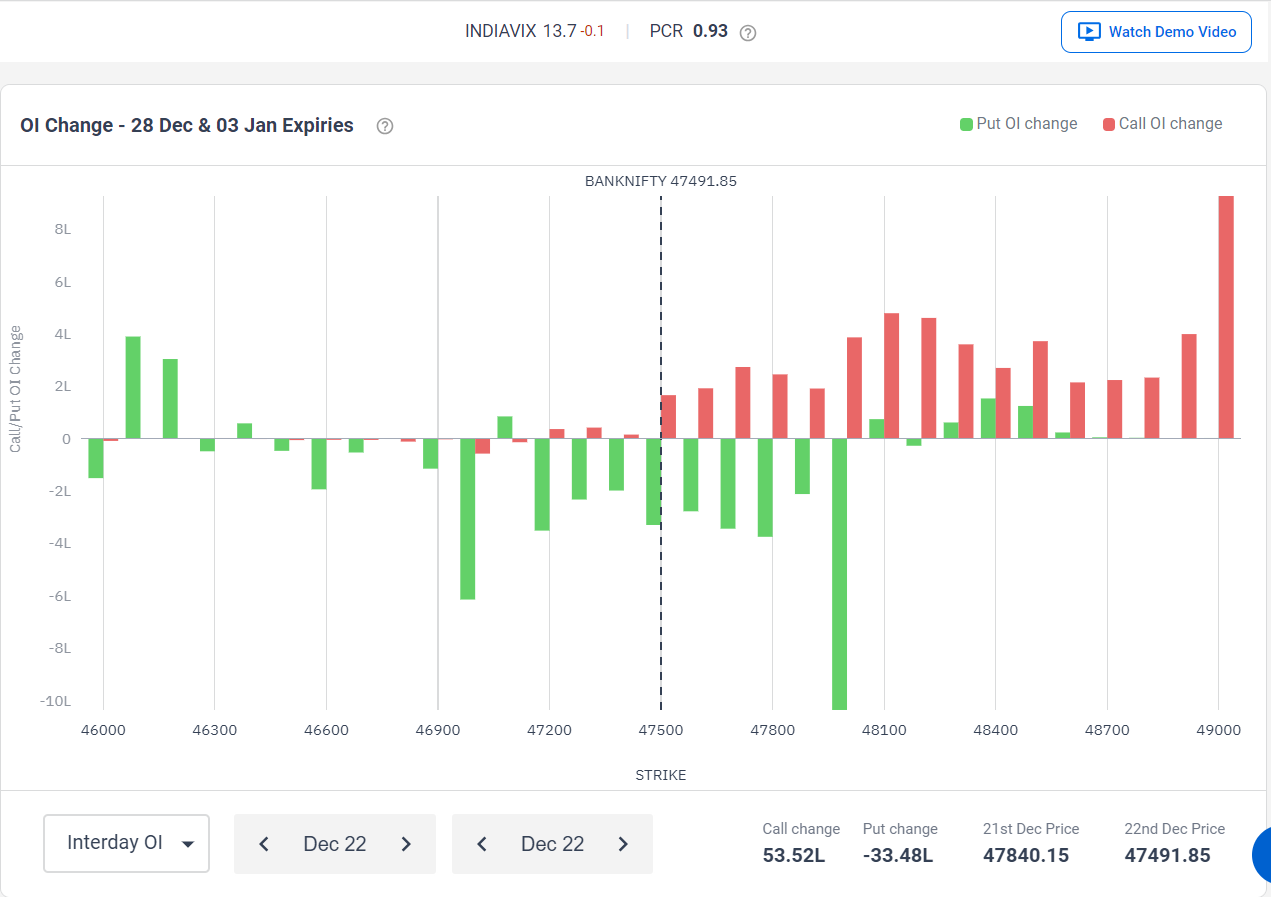

Observations:

OI data suggest market to remain volatile, selling from the top observed.

Nifty OI

- Max OI Calls:: 21500 , 0.83 Cr

- Max OI Puts:: 21000, 1.03 Cr

- PCR:: 1.0

Note:: OI suggests strong support at 21000 , and a Resistance at 21500. Likely to remain volatile.

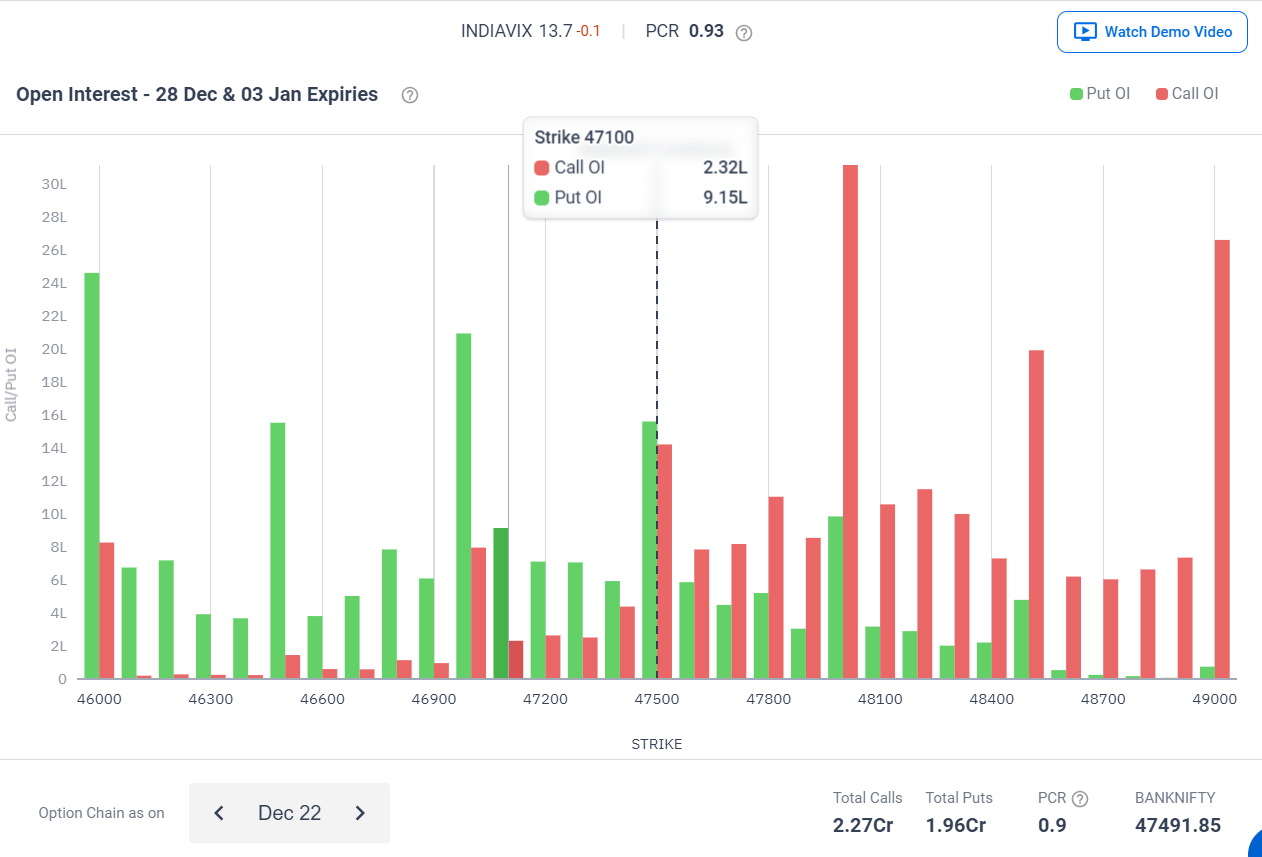

Banknifty OI

- Max OI Calls:: 48000 , 0.31 Cr

- Max OI Puts:: 46000 , 0.24 Cr

- PCR:: 0.9

Note:: OI suggests a support at 46000 , but Resistance at 48000. Likely to remain volatile