ETFs Vrs Mutual Funds

Blogs , ETF

Exchange-Traded Funds (ETFs) and Mutual Funds are both popular investment vehicles, but they have some key differences that set them apart. Here’s a comparison between ETFs and Mutual Funds to help investors understand their characteristics and choose the one that aligns with their investment goals: Structure: Management Style: Trading and Liquidity: Minimum Investment: Expenses: Tax […]

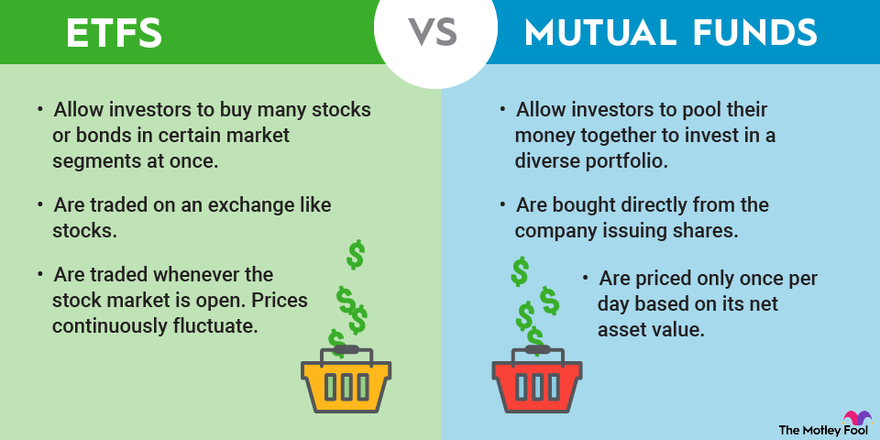

Exchange-Traded Funds (ETFs) and Mutual Funds are both popular investment vehicles, but they have some key differences that set them apart. Here’s a comparison between ETFs and Mutual Funds to help investors understand their characteristics and choose the one that aligns with their investment goals:

Structure:

- ETFs:

- ETFs are traded on stock exchanges, just like individual stocks.

- They can be bought and sold throughout the trading day at market prices.

- ETFs have a unique creation and redemption process involving Authorized Participants, which helps keep the market price close to the Net Asset Value (NAV).

- Mutual Funds:

- Mutual funds are bought or sold at the end of the trading day at the Net Asset Value (NAV) price.

- Transactions are executed at the closing price, regardless of when during the trading day the order was placed.

- Mutual funds are managed by fund companies that issue new shares to buyers and redeem shares from sellers directly.

Management Style:

- ETFs:

- ETFs can be passively managed, tracking an index’s performance.

- They can also be actively managed, with fund managers making investment decisions to outperform the market.

- Mutual Funds:

- Mutual funds can be actively managed, where fund managers actively make investment decisions.

- Some mutual funds also passively track an index, similar to index-tracking ETFs.

Trading and Liquidity:

- ETFs:

- Traded on stock exchanges, ETFs offer intraday trading flexibility.

- Investors can place limit and stop orders and engage in short selling.

- Mutual Funds:

- Bought or sold at the end of the trading day at the NAV price.

- Orders are executed at the next calculated NAV, and there are no intraday trading options.

Minimum Investment:

- ETFs:

- Investors can buy as few shares as they want, making them accessible for investors with small amounts of capital.

- Mutual Funds:

- Mutual funds often have minimum investment requirements, which can vary from fund to fund.

Expenses:

- ETFs:

- Generally have lower expense ratios compared to actively managed mutual funds.

- Passive ETFs, in particular, can be very cost-effective.

- Mutual Funds:

- Actively managed mutual funds tend to have higher expense ratios due to the costs associated with active management.

Tax Efficiency:

- ETFs:

- Typically more tax-efficient due to the “in-kind” creation and redemption process, which can help minimize capital gains distributions.

- Mutual Funds:

- May distribute capital gains to investors when the fund manager sells securities within the fund, potentially resulting in tax implications for investors.

The choice between ETFs and Mutual Funds depends on an investor’s preferences, investment strategy, and specific needs. ETFs are often favored for their liquidity, intraday trading capabilities, and cost efficiency, while mutual funds may be preferred for their simplicity, particularly for long-term investors who prioritize ease of use and don’t require intraday trading features. Ultimately, investors should carefully consider their goals and the characteristics of each investment vehicle before making a decision.