Covered Call – A Safe Trade

Blogs

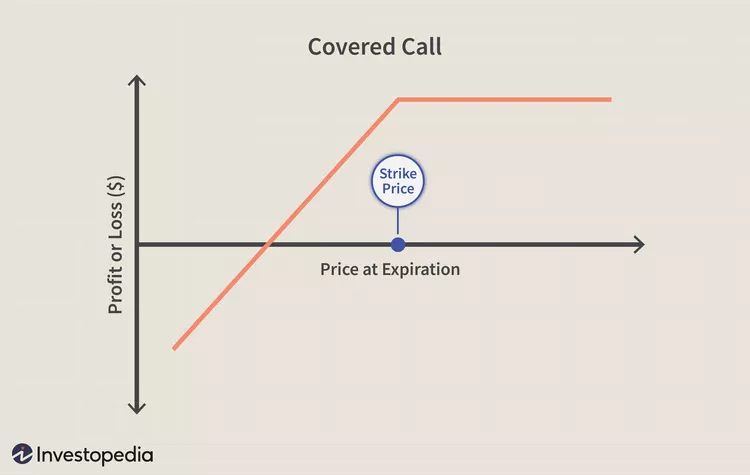

Covered calls are a neutral strategy, meaning the investor only expects a minor increase or decrease in the underlying stock price for the life of the written call option…[..]

What is a Covered Call?

A financial transaction in which an investor who holds long positions of securities or equities sell call options of equivalent amount of the underlying security or equities. To execute this, an investor who holds a long position in an asset then writes (sells) call options on that same asset to generate an income stream. The investor’s long position in the asset is the cover because it means the seller can deliver the shares if the buyer of the call option chooses to exercise.

KEY TAKEAWAYS

- A covered call is a popular options strategy used to generate income in the form of options premiums.

- Investors only expect a minor increase or decrease in the underlying stock price for the life of the option when they execute a covered call.

- To execute a covered call, an investor holding a long position in an asset then writes (sells) call options on that same asset.

- Covered calls are often employed by those who intend to hold the underlying stock for a long time but do not expect an appreciable price increase in the near term.

- This strategy is ideal for investors who believe the underlying price will not move much over the near term.

Understanding Covered Calls

Covered calls are a neutral strategy, meaning the investor only expects a minor increase or decrease in the underlying stock price for the life of the written call option. This strategy is often employed when an investor has a short-term neutral view of the asset and for this reason, holds the asset long and simultaneously has a short position via the option to generate income from the option premium.

Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income (premiums) for their account while they wait out the lull.

A covered call serves as a short-term hedge on a long stock position and allows investors to earn income via the premium received for writing the option. However, the investor forfeits stock gains if the price moves above the option’s strike price. They are also obligated to provide 100 shares at the strike price (for each contract written) if the buyer chooses to exercise the option.

If the investor simultaneously buys a stock and writes call options against that position, it is known as a buy-write transaction.

Advantages and Disadvantages of Covered Calls

Reliable Premiums

An options writer can earn money by selling a covered call, but they lose the potential profits if the call goes into the money. However, the writer must be able to produce 100 shares for each contract if the call expires in the money. If they do not have enough shares, they must buy them on the open market, causing them to lose even more money.

Limited Losses

Covering calls can limit the maximum losses from an options transaction, but it also limits the possible profits. This makes them a useful strategy for institutional funds and traders because it allows them to quantify their maximum losses before entering into a position.1

Loss of Potential Upside

A covered call strategy isn’t useful for very bullish or very bearish investors.2 Very bullish investors are typically better off not writing the option and just holding the stock. The option caps the profit on the stock, which could reduce the overall profit of the trade if the stock price spikes.

When to Use and When to Avoid Covered Calls

The best time to sell covered calls is when the underlying security has neutral to optimistic long-term prospects, with little likelihood of either large gains or large losses. This allows the call writer to earn a reliable profit from the premium.

Covered calls are not an optimal strategy if the underlying security has a high chance of large price swings. If the price rises higher than expected, the call writer would miss out on any profits above the strike price. If the price falls, the options writer could stand to lose the entire price of the security, minus the initial premium.

Covered Call with Index Futures

NOTE:- This section is published in QUANTSAPP

By : SHUBHAM AGARWAL is a CEO & Head of Research at Quantsapp Pvt. Ltd. He has been into many major kinds of market research and has been a programmer himself in Tens of programming languages. Earlier to the current position, Shubham has served for Motilal Oswal as Head of Quantitative, Technical & Derivatives Research and as a Technical Analyst at JM Financial.

Buy a Futures contract and simultaneously Sell a Higher Strike Call option.

Covered Call = Long Future + Short Higher Strike Call

The strategy is simple; instead of just buying a naked Futures contract, we buy a Futures contract and simultaneously Sell a Higher Strike Call option.

Markets have been slow for the past few days. The loss of momentum does not impact Futures traders much. However, quick entry and exit are not possible in such times. Most of the trades become a wait-and-watch game.

The biggest disadvantage is that due to lack of momentum sometimes we lose patience. Due to this, we end up exiting the trade right before momentum sets in. During such times how about creating a strategy that helps us get money out of a lack of momentum? This is possible when we convert our Buy Futures strategy into Covered Call Strategy.

What is a Covered Call?

Covered Call = Long Future + Short Higher Strike Call

The strategy is simple; instead of just buying a Futures contract, we buy a Futures contract and simultaneously Sell a Higher Strike Call option.

Normal convention is to sell a Call option with the same expiry and with a Strike Price that is closest to the Target Price of the buy trade. This trade includes two positions, hence the margin requirement will be higher but not so high. Let us understand.

As we all know selling a Call Option has unlimited loss potential if the stock goes up a lot. However, buying Future has unlimited profit potential if the stock goes up a lot.

Because we have both Buy Future and Sell Call together there is a margin benefit. Selling a Call Option and Buying a Future would require more margin if done at different times but if done simultaneously, there is a slight benefit in the margin.

What are the Pros and Cons?

Pros:

1. It is not hidden from anyone that Option premium reduces in value as every day passes by. This decline in Premium is more obvious when there is no or less movement in the price of the stock.

In the covered call Strategy , we will be able to take advantage of this property of options and make money while we wait.

2. Also, when we sell options, we receive premium. Call Option premium goes up with stock price going up and goes down with stock price going down. So, if unfortunately, if the stock goes down after Buying the Future and Selling a Call, we will be losing less money due to profit from Sold Call premium reduction.

Cons:

1. The only disadvantage is that maximum profit in this strategy is limited.

Maximum Profit= Sold Call Option Strike – Buy Future Price + Premium

Example :

Bought Future @100 + Sold 105 Call @1

Max Profit = 105- 100 + 1 = 6

Imagine if the stock goes to 120 after the Covered Call was done we will still be making 6. So, this strategy can not be done always.

When to do a Covered Call?

We should do Covered Call only when there is a lack of momentum in the market. This can be observed from recent days’ and weeks’ movement in the indices. The current time is such time.

What is the Exit Strategy?

Well, just like a Futures trade, we exit the trade at Target (Both Future & Option). Also, the Stop Loss in Buy futures trade should be executed as well.

Both Profit and Loss in Covered Call Strategy are lower with the benefit that if the stock does not move till expiry there will still be profitable due to Sell Call position.