Break Out Trading

Blogs

Breakout trading is a popular strategy in financial markets,

Breakout trading is a popular strategy in financial markets, especially in stocks, forex, and commodities. The basic idea behind breakout trading is to take advantage of significant price movements that occur when an asset’s price breaks through a predefined support or resistance level. Traders who employ breakout strategies aim to capitalize on the momentum generated by such price movements. Here’s a breakdown of key concepts related to breakout trading:

Support and Resistance Levels:

- Support Level: A price level at which a financial asset tends to stop falling and may even bounce back.

- Resistance Level: A price level at which a financial asset tends to stop rising and may face selling pressure.

Breakout Patterns:

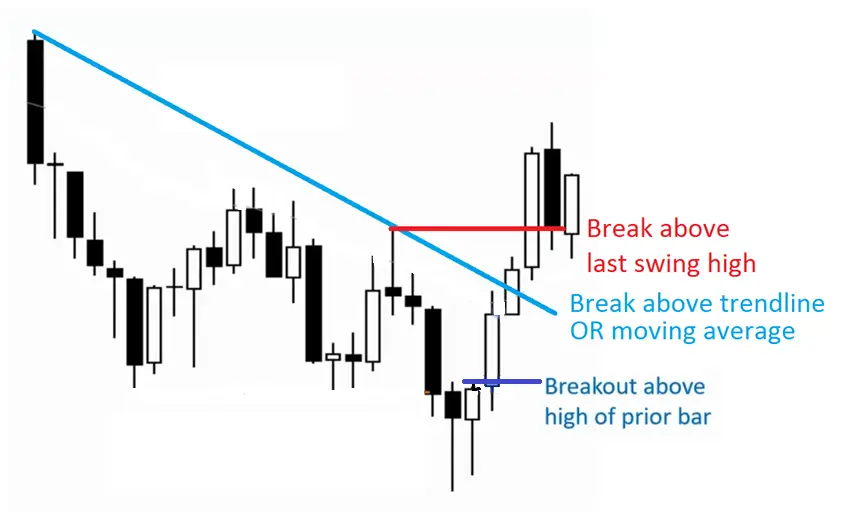

- Breakout: The point at which the price of an asset moves above resistance or below support, signaling a potential trend reversal or continuation.

- Breakdown: The opposite of a breakout, occurring when the price moves below support, indicating a potential downtrend.

Types of Breakouts:

- Continuation Breakout: Occurs when the price breaks through a level, continuing the existing trend.

- Reversal Breakout: Signals a potential change in trend direction.

Confirmation and False Breakouts:

- Traders often wait for confirmation before entering a trade to reduce the risk of false breakouts.

- False breakouts occur when the price briefly moves beyond a support or resistance level but fails to sustain the move.

Volatility:

- Breakouts are often associated with increased volatility in the market.

- Volatility can provide opportunities for traders but also poses risks, as prices can move rapidly.

Risk Management:

- Setting stop-loss orders is crucial to manage risk, especially in breakout trading where price movements can be swift and unpredictable.

- Traders may use various risk management techniques, such as position sizing and setting predetermined risk-reward ratios.

Trading Tools:

- Technical indicators like Moving Averages, Bollinger Bands, and Relative Strength Index (RSI) can assist traders in identifying potential breakout opportunities.

- Chart patterns, such as triangles, flags, and rectangles, are often used to anticipate breakouts.

News and Events:

- External factors, such as economic reports, earnings announcements, or geopolitical events, can trigger significant price movements and breakouts.

It’s important to note that while breakout trading can be profitable, it also involves risks. Traders should carefully analyze market conditions, use risk management strategies, and stay informed about relevant news and events. Additionally, individual traders may have different preferences and adapt breakout strategies to suit their trading styles.