Data for 7th December, 2023 Expiry

#safebull , Information , Market

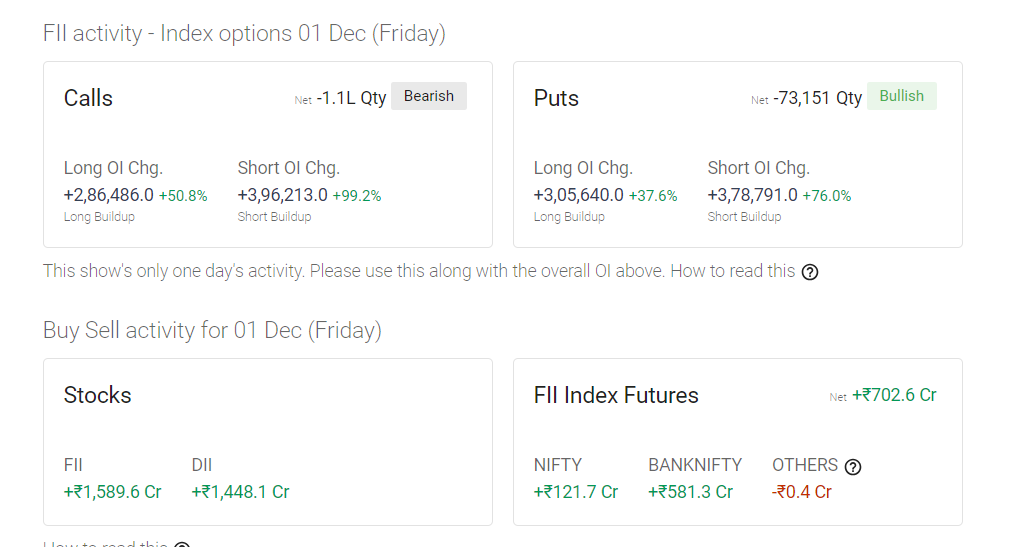

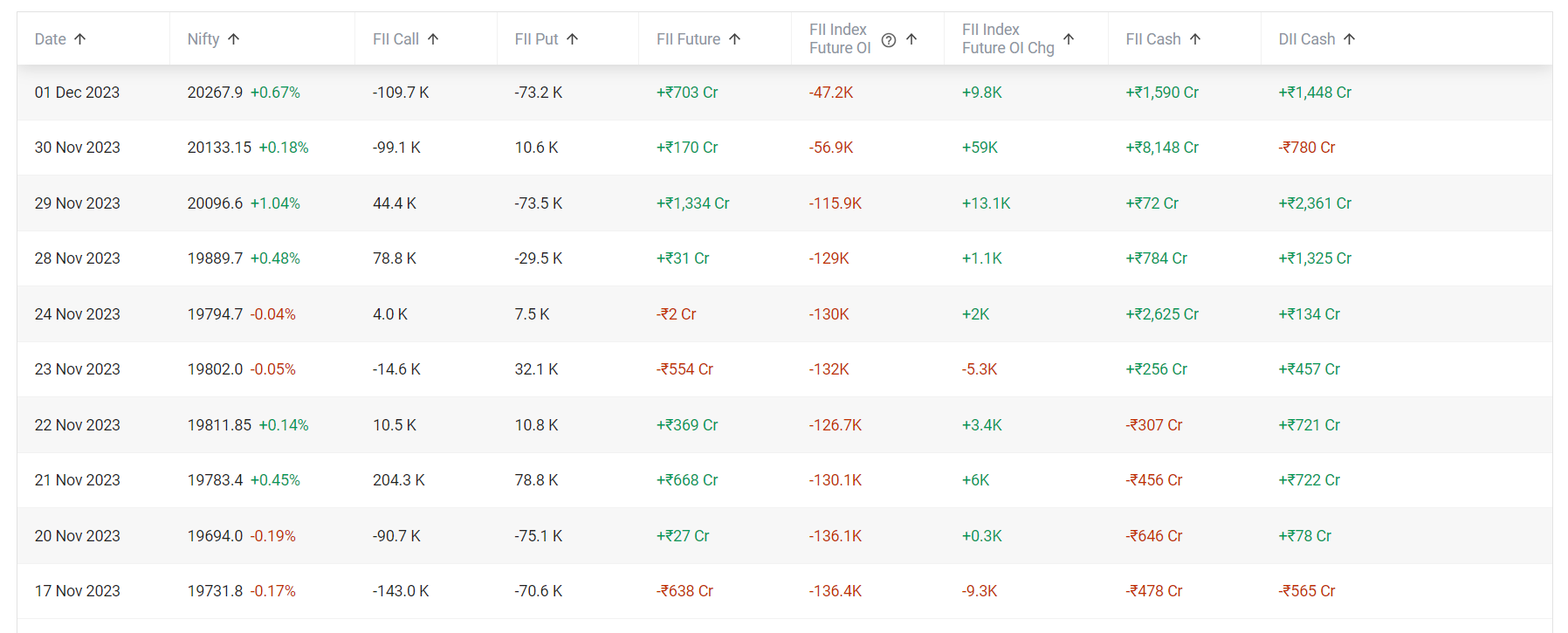

FII & DII Data

Observations:

FII & DII data suggest market to remain volatile, but heavier on negative side even though its too early to say.

- Outstanding puts is 2.4L against 50k calls – Looks Bearish.

- Last session FII futures activity – Decently on positive.

- FII stocks is 1.5K cr – Does not hold relevance for intraday but swing wise positive.

- Net Future OI change = +9.8K, Looks positive.

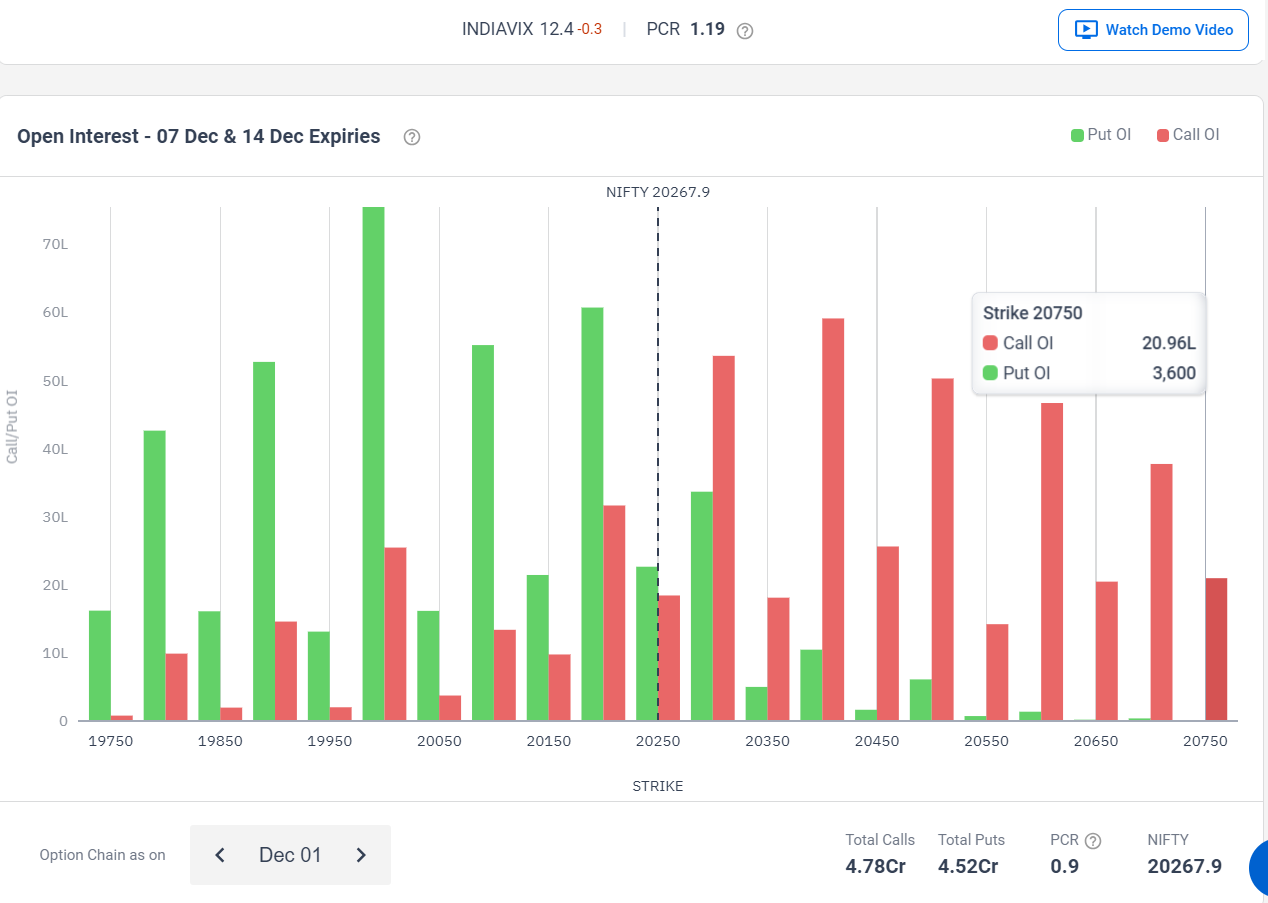

Open Interests

Observations:

OI data suggest market to remain volatile, but heavier on negative side at high levels.

Nifty OI

- Max OI Calls:: 20,400 , 0.59 Cr

- Max OI Puts:: 20,000 , 0.75 Cr

- PCR:: 0.9, Flat to Bullish

Note:: OI suggests support at 20000 , but strong Resistance at 20400.

Banknifty OI

- Max OI Calls:: 45,000 , 0.30 Cr

- Max OI Puts:: 44,500 , 0.24 Cr

- PCR:: 0.8

Note:: OI suggests nominal support at 44500 , but strong Resistance at 45000.