14th June 2024 – The Trades

Blogs , Trading Life , Trading Mistakes

SHILLONG :: Seeing some consolidation near the opening range, I shorted 78900 call at 10:12am- kept a tight stoploss at the day high…[..]..

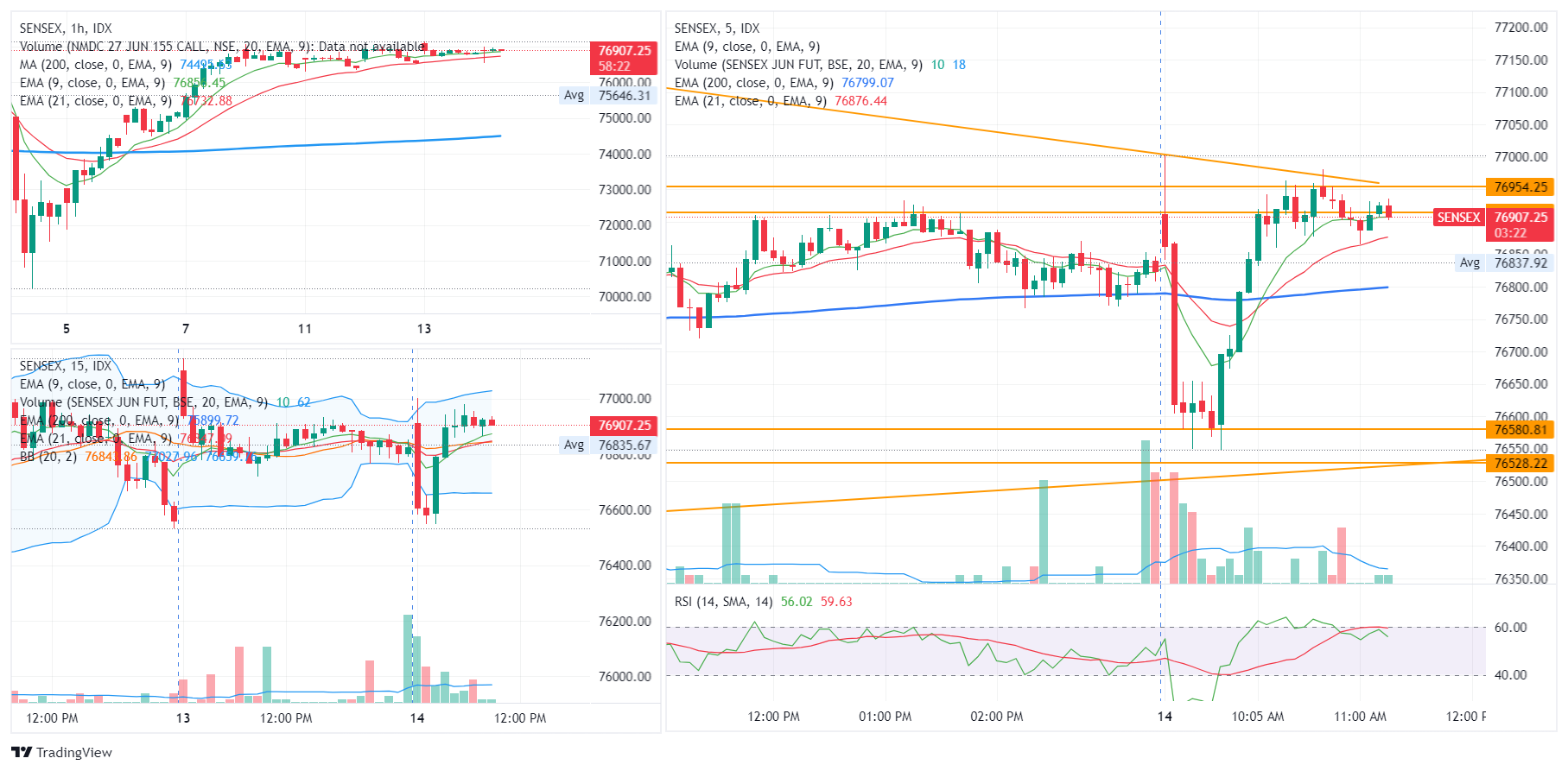

:: The View

My market view today was biased towards positive side as Indian market is trading near all time high, no negative news to play spoil sport to the rising market. But my inclination would be bearish if it opens gap up till it fills the gap.

:: The Opportunity

Market did open gap up, and my target today is SENSEX being a weekly expiry. Sensex opened gap up at 77150 level approximately, could have leverage the call short but I was not in the trade desk- in fact I was driving. Could not capitalize it, but in a way protected me. By the time I was at the trade desk it was 10:12am, and market had sharply recovered and was trading at 76900 level. Seeing some consolidation near the opening range, I shorted 78900 call at 10:12am- kept a tight stoploss at the day high.

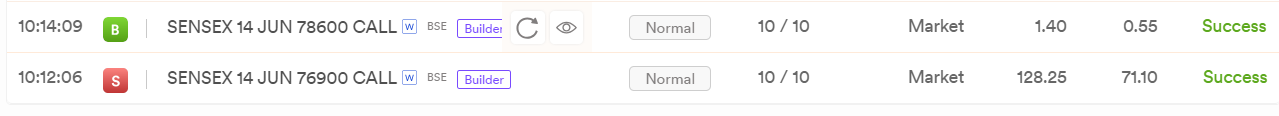

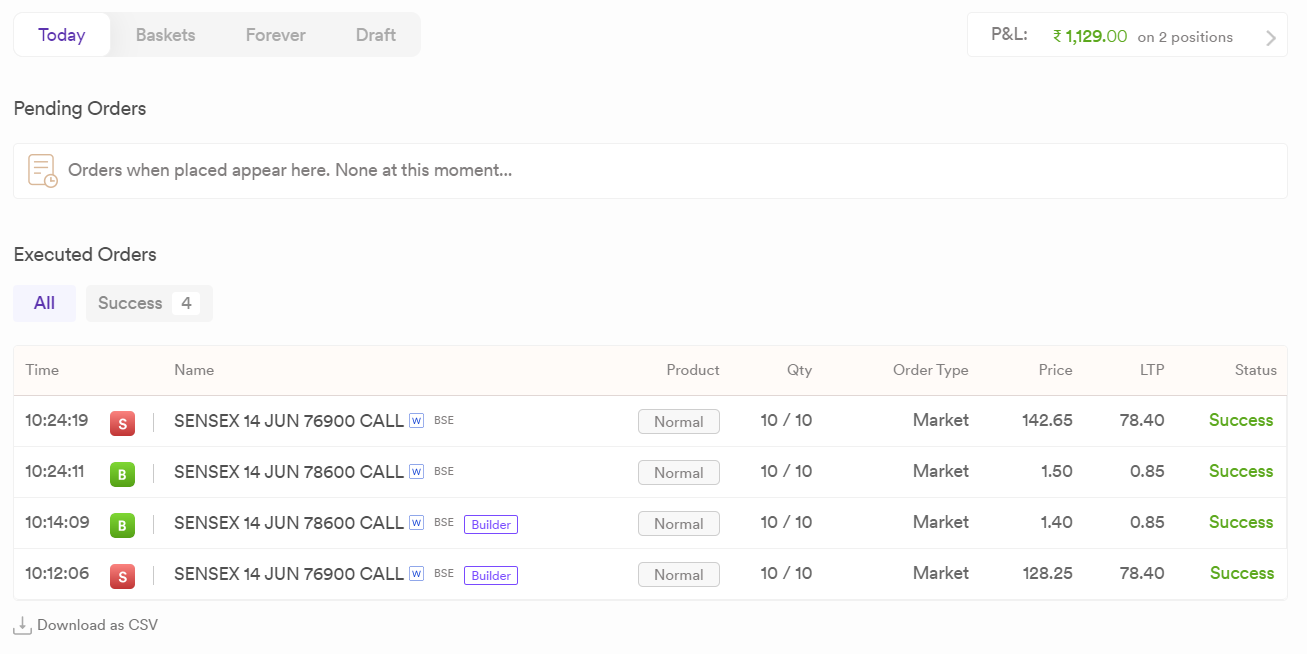

As the market was dynamically moving and a bend in the trajectory was observed, I added some more of 78900 call, and added a hedge too to get the margin benefit. The orders are as in the order book below.

:: The Order Book

:: The Chart

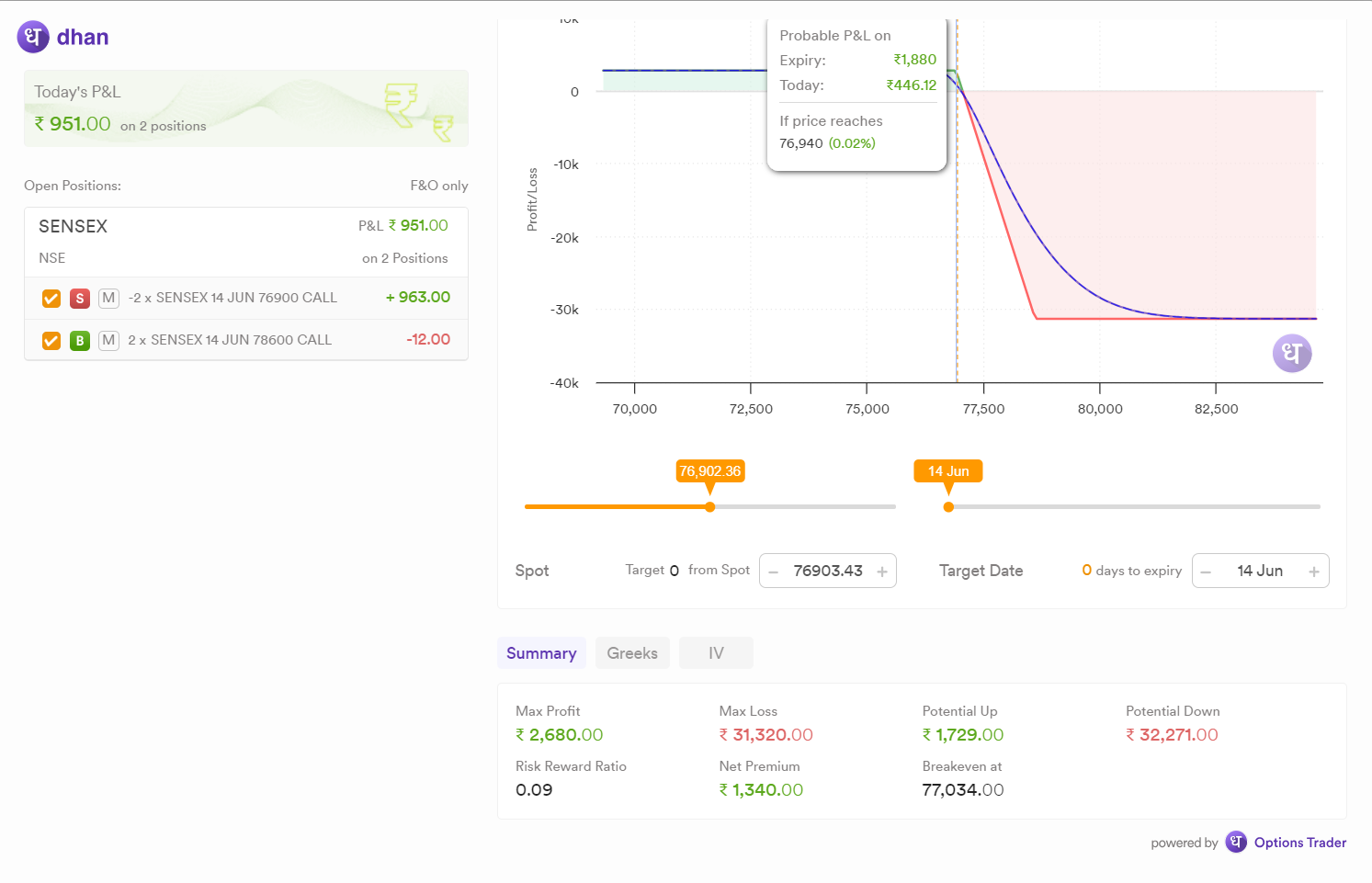

:: The P&L Graph

:: The Day End

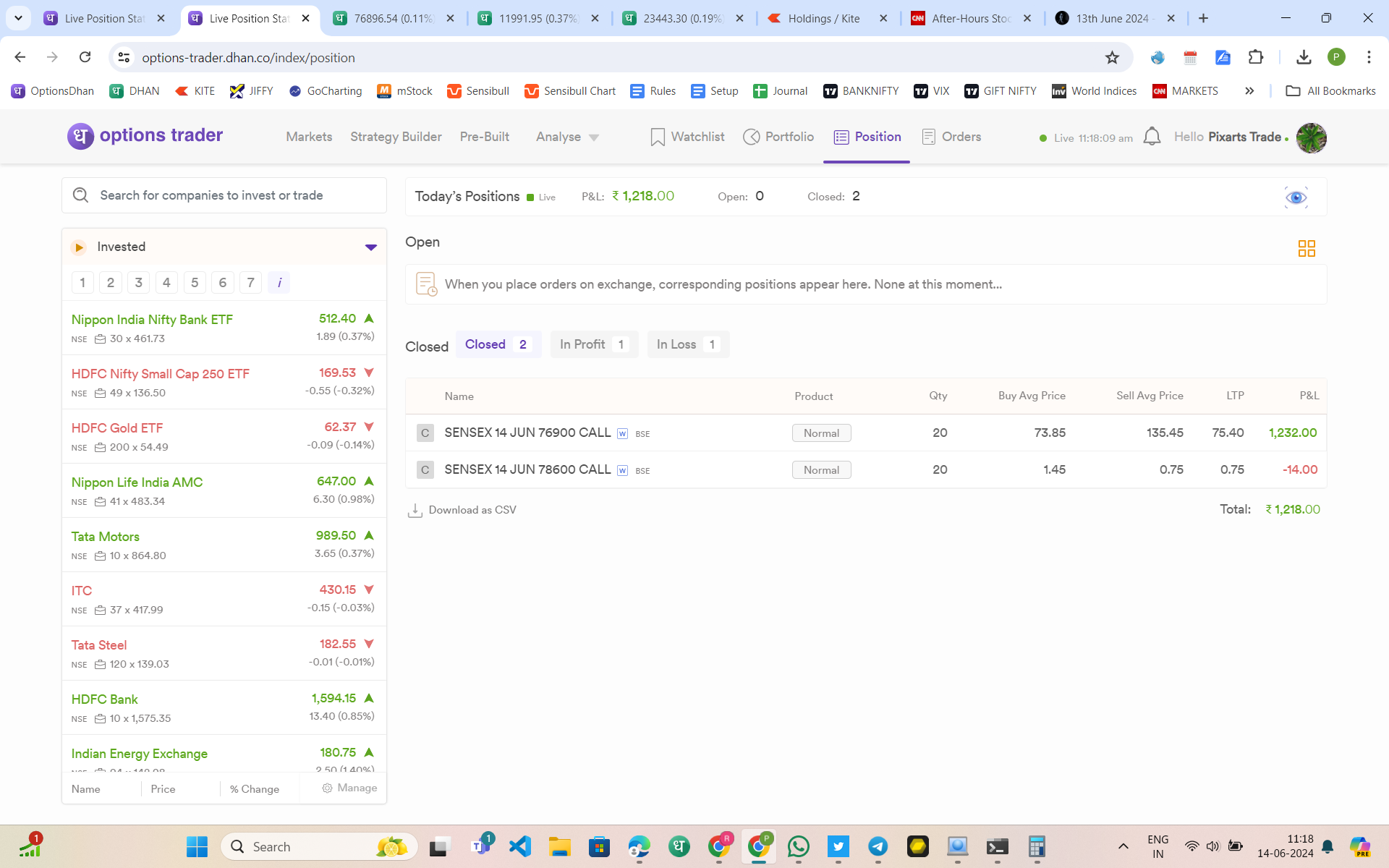

All trades were closed at 11:18am, as it was near my target today, and don’t want to loose my wins if any unwanted volatility at 1pm, and I was observing recovery in the market. And the bigger trend is still bullish, it is best to avoid bearish trades or book quickly.

:: The Verified P&L by Dhan

I missed the early morning opportunity today, but I saw an opportunity at 10:14am for bearish entry, and entered quickly and exit as well, as the bigger trend is still bullish. And at the end I managed a decent Positive(+) MTM and approximately 0.8% capital gain, and the following is the verified P&L– verified by Dhan.

:: General Information

- Trading Capital: 1.5L

- Daily Target: 1% ( Rs 1500 Approx.) of 1.5L

- My Trading Style: ATM/ITM Options Directional Sell, Intraday/Scalping mostly.